seattle payroll tax lawsuit

The Seattle payroll tax which took effect Jan. A King County judge Friday tossed out a lawsuit against Seattles new tax on high-earning workers at big businesses ruling that it is within the citys authority to.

Jumpstart Prevails Court Dismisses Chamber Lawsuit The Urbanist

The lawsuit invokes state Supreme Court case law Cary vs.

. This morning the Seattle Metropolitan Chamber of Commerce announced that it has filed a lawsuit in King County Superior Court arguing that the Jump Start payroll tax passed by the Seattle City Council last summer violates the Washington State Constitution. The payroll expense tax in 2022 is required of businesses with. The chamber says more than 210 stores and businesses have permanently closed in Seattle since the start of the pandemic.

The Seattle Metropolitan Chamber of Commerce is appealing the dismissal of its lawsuit against the citys new tax on high salaries at big businesses. SEATTLE METRO CHAMBER 1301 Fifth Avenue Suite 1500 Seattle WA 98101 206 389-7200 Contact Us. The legal challenge to the tax ordinance brought by the Seattle Metropolitan Chamber of Commerce argued that.

A lawsuit challenging the JumpStart Seattle tax was filed after it was approved last year. 31 2022 accounting experts envision. The tax ranges from 07 to 24 depending on payroll expense and the amount of employee compensation that exceeds 150000.

7386494 or more of payroll expense in Seattle for the past calendar year 2021 and. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. The Seattle City Council overstepped when.

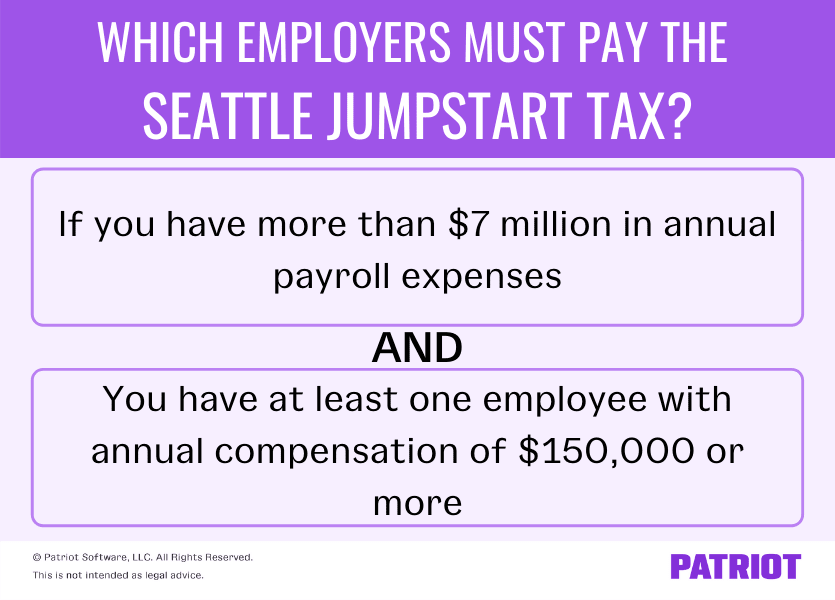

The top 24 rate which was meant to apply to a company like Amazon will be levied on salaries of at least 400000 at companies with at least. The table below shows the applicable tax rates. The tax applies to businesses that spend 7 million or more on payroll.

The city estimates that the tax will affect around 1 of Seattle businesses. 1 applies to businesses with annual payroll costs of at least 7 million. The Chamber writes This illegal tax puts Seattles economic recovery at risk now and years into the future said Alicia Teel the Chambers senior vice president of public affairs and communications.

In a lawsuit filed in King County Superior Court on Tuesday the business group alleges the citys payroll tax also known as Jumpstart Seattle is a tax on the right to earn a living and not the right to do business in the city. The JumpStart Seattle revenue plan better known as the payroll tax went into effect this month and although the first payments arent due until Jan. The Chambers legal team at Perkins Coie filed the appeal in Division I of the Washington State Court of Appeals.

Seattles new payroll tax survived its first court challenge last June and the city collected 231m from affected businesses in 2021. Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. This afternoon King County Superior Court Judge Mary Roberts ruled in favor of the City of Seattle upholding as constitutionally permissible the citys payroll tax enacted last summer and dismissing a lawsuit challenging it.

As shown in the table above for businesses with annual Seattle payroll expense greater than 7 million either a 7 or 14 tax rate. City of Bellingham which held that earning a. But the lawsuit argues that.

Under the tax businesses with at least 7 million in annual payroll will be taxed at rates of between 07 to 24 on salaries and wages paid to Seattle employees who make at least 150000 per year. Businesses pay the tax for each employee who makes 150000 a year or. The Seattle Metropolitan Chamber of Commerce today filed a lawsuit challenging Seattles controversial payroll tax.

According to the councils calculations the tax is projected to raise 214 million in 2021 and 219 million in 2022. SEATTLE July 2 2021 Today the Seattle Metropolitan Chamber of Commerce filed an appeal of the recent decision in the membership organizations lawsuit against the city of Seattles JumpStart Tax.

An Update On Seattle S New Payroll Tax Irs Trouble Solvers Alabama

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Here S What S Next For Seattle S Payroll Tax After Failed Court Challenge Puget Sound Business Journal

Seattle Chamber Appeals Dismissal Of Suit Against City S Jumpstart Tax Knkx Public Radio

Seattle S Payroll Tax Complicates Efforts To Implement One Statewide

Seattle S Big Business Tax 1 Year Later Controversial Policy Generates Unexpected Surplus Geekwire

Jumpstart Prevails Court Dismisses Chamber Lawsuit The Urbanist

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

Mckenna Difference Is Clear Between New State Payroll Capital Gains Taxes Mynorthwest Com

Chamber Of Commerce Renews Push To Overturn Seattle Big Business Tax Mynorthwest Com

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

How Do You Achieve Pay Equity At Your Tech Company Protocol

Kuow Seattle S Payroll Tax Is Thriving But Faces Next Legal Challenge

Seattle S Payroll Tax Could Be An Accounting Nightmare For Employers Puget Sound Business Journal

Seattle S Big Business Tax 1 Year Later Controversial Policy Generates Unexpected Surplus Geekwire

New Seattle Jumpstart Tax Overview Rates More

Cvs Just Laid Out A Big Reason Why Health Companies Are Worried About Amazon Payroll Taxes Payroll Working For Amazon

Seattle Metropolitan Chamber Of Commerce Sues City Over Illegal Payroll Tax On Big Businesses Geekwire

Here S What S Next For Seattle S Payroll Tax After Failed Court Challenge Puget Sound Business Journal